Do I Need Gap Insurance On A Used Car

NEWS

Do I Need Gap Insurance?

Cars.com illustration by Paul Dolan

By Rick Cotta

September 11, 2022

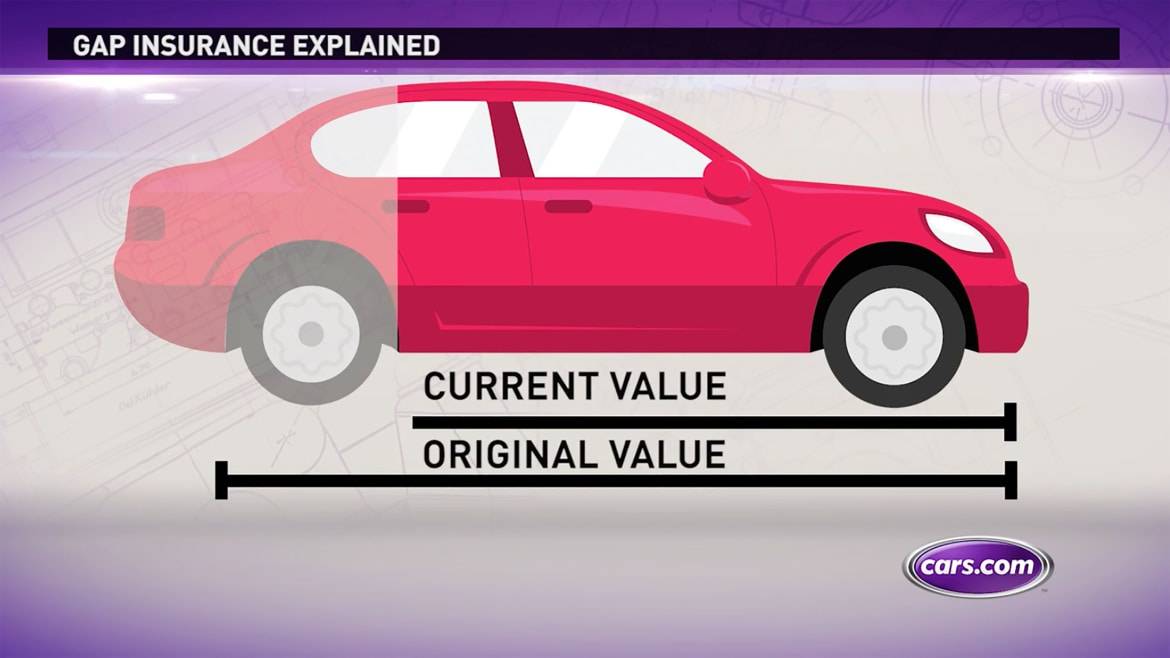

Equally it pertains to cars, gap insurance covers the difference betwixt what you owe on your car loan and the actual cash value of your car if it's totaled in a crash. That "gap" can corporeality to quite a bit of coin, which you'd otherwise take to pay out of your own pocket — particularly if you didn't put much coin down when you bought the machine (less than 20% or then) or took out a long-term loan (say, for more than five years). While the cost of gap insurance varies widely with the car, information technology can ofttimes be had in the $20-$threescore per year range, and you typically simply need it for the first few years. Hither's how to determine if you lot need gap insurance for your vehicle.

Related: What Is Gap Insurance?

Should I Become Gap Insurance?

If you owe more on your car than information technology's worth, information technology's called beingness "upside downwards" or "underwater." This can happen very hands because a new auto tends to depreciate quite a bit in its early years. Furthermore, if you took out a loan with interest, a asymmetric amount of your early monthly payments typically goes to paying off the total corporeality of interest owed over the length of the loan rather than paying off the principal on the car. (Toward the terminate of the loan, it reverses.)

For many people, gap insurance only makes sense for the first few years of ownership while they're paying off a loan. Eventually, the amount you've paid toward the primary volition take reduced the corporeality you still owe to less than the machine's value, eliminating the need for gap insurance.

For instance, if you took out a $20,000 loan on your car and paid off $12,000 in principal — leaving $viii,000 to go — and the machine is worth at least that same $viii,000 if it'southward totaled, you no longer demand gap insurance. However, it's important to retrieve to subtract the amount of your deductible from what the insurance company says is your automobile's value, as that deductible could easily be $500-$1,500 or more. In the case higher up, if y'all have a $1,000 deductible and the value of your auto is $8,000, yous may want to keep your gap insurance until yous have $7,000 left in principal.

The chip shortage has limited the number of new vehicles that tin can be built, which greatly increases the toll of new cars and the value of used ones. That's good if you bought a automobile before prices went up, merely if yous bought a machine after prices went upwards — and took out a loan for information technology — that could put you in a bad position when car prices drop back to normal. This would be a prime example of when information technology could be a good idea to get gap insurance.

Where Tin can I Get Gap Insurance?

While the dealer where you bought the automobile or the financial institution from which you got your loan would both like to sell you gap insurance, another selection is getting it through your insurance visitor if it'south offered. For one thing, you may well be dealing with information technology already if your automobile is totaled. Likewise, you probably renew your insurance every 6-12 months, and then information technology'due south easier to be reminded to compare your car'southward value to how much y'all owe on it to determine if you all the same demand gap insurance.

How Do I Determine My Car's Value?

Since your insurance visitor may be the entity determining how much you'd get paid if your car was totaled, it might exist worthwhile to inquire what source it uses to institute your car's value.

Financial institution LendingTree.com suggests using industry standards such every bit Kelley Blue Book and NADAguides.com to make up one's mind off-white market value. Note that the merchandise-in value on whatever of these sites volition be lower than retail or private-political party values, and then bank check on which is used. Beware if Black Book is the source, nonetheless: It's primarily for dealers, tends to quote lower figures and isn't available online for gratis. Once yous know how your car's value is determined, you can check it online yourself.

More From Cars.com:

- How to Become a Machine Loan

- How Much Car Insurance Practise I Need? five Key Coverage Considerations

- More Car Insurance Coverage

- Find Your Next Machine

- Are Certified Pre-Owned Cars Worth It?

Related Video:

Cars.com's Editorial department is your source for automotive news and reviews. In line with Cars.com'due south long-continuing ethics policy, editors and reviewers don't take gifts or free trips from automakers. The Editorial department is independent of Cars.com'south ad, sales and sponsored content departments.

Do I Need Gap Insurance On A Used Car,

Source: https://www.cars.com/articles/do-i-need-gap-insurance-456484/

Posted by: gasparddienteor.blogspot.com

0 Response to "Do I Need Gap Insurance On A Used Car"

Post a Comment